Preparing Your E Forms

New Year, New tax return. Preparing your E forms (Borang E) for tax return submission is important. Knowing the type of tax forms is as equally as important. Thus, if you’re confused on the how-to of the submission of the forms online as well as knowing what kind of forms there are, here is a guide to knowing your forms and how to submit it.

What are your forms?

There are many types of forms that you need to know for your own knowledge as well as knowing what type of forms suitable to your business and employment type. Starting from 1st March 2021, employers and their employees are to submit their annual income tax to LHDN until the following datelines below:

- Borang E: 1/3/2021 - 31/3/2021

- For employees: Business owner reporting their annual salaries

- Borang BE: 1/3/2021 - 30/4/2021

- Resident Individual who does not carry on any business

- Borang B: 1/3/2021 - 30/6/2021

- Resident Individuals who carry on business

- Borang P: 1/3/2021 - 30/6/2021

- For Partnership type business

Others:

- Borang BT/M/MT/TP/TF/TJ

- Those that DO NOT carry on business: 1/3/2021 - 30/4/2021

- Those that carry on with business: 1/3/2021 - 30/6/2021

If you fail to submit your income tax return, you will be given a fine between RM200 to RM20,000 and/or imprisonment up to 6 months under the Income Tax Act Section 120(1)(b).

Preparing your E form for submission

In order to submit, you must log-in to the Lembaga Hasil Dalam Negeri (LHDN) website as that’s where workers settle their tax form submissions:

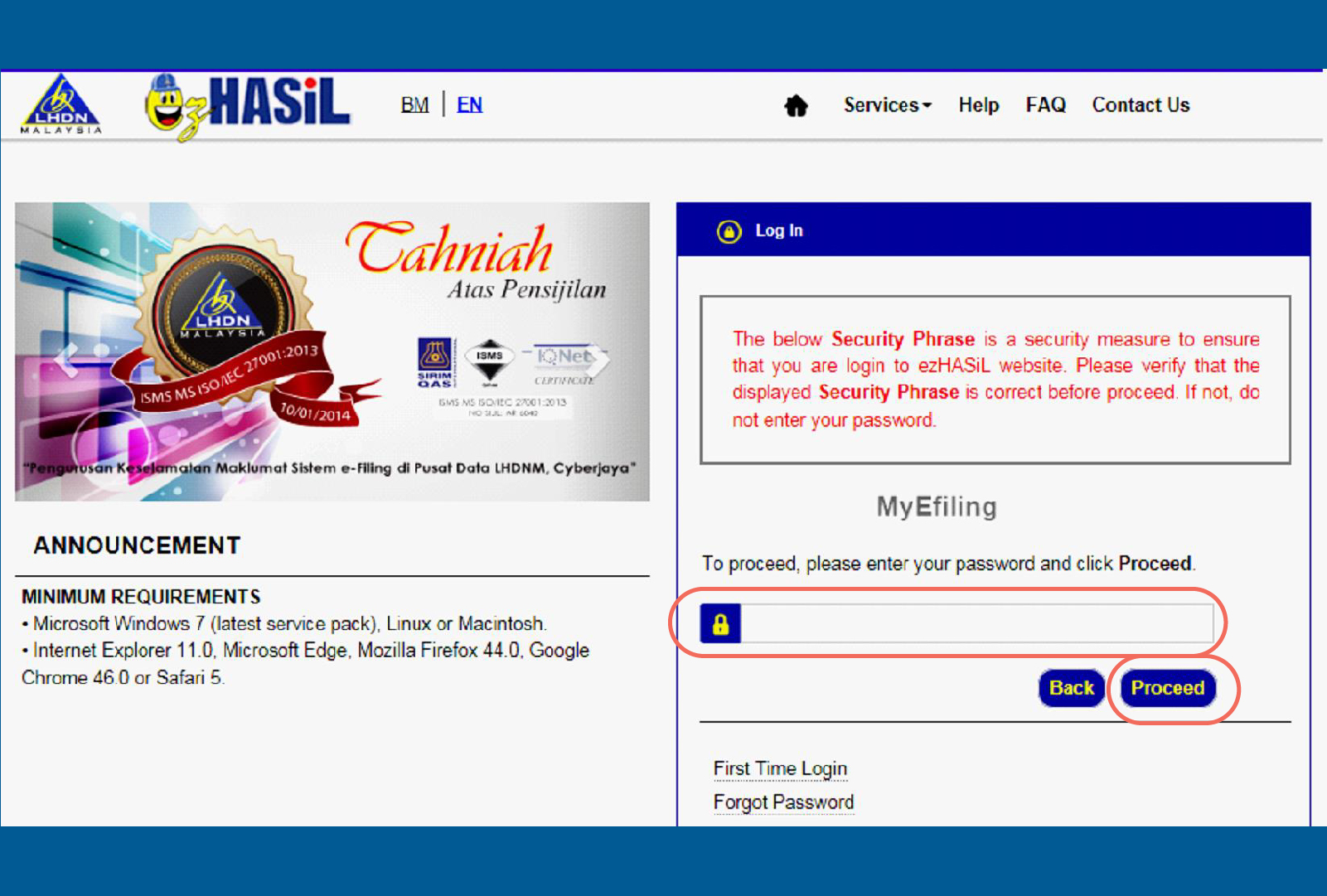

1. Log-in from the LHDN website:

ez.hasil.gov.my/CI/

2. Upon logging in, enter your IC number click [Submit].

After that, verify your Security Phrase and then proceed to enter your Password. Once all of that is done, click [Proceed]

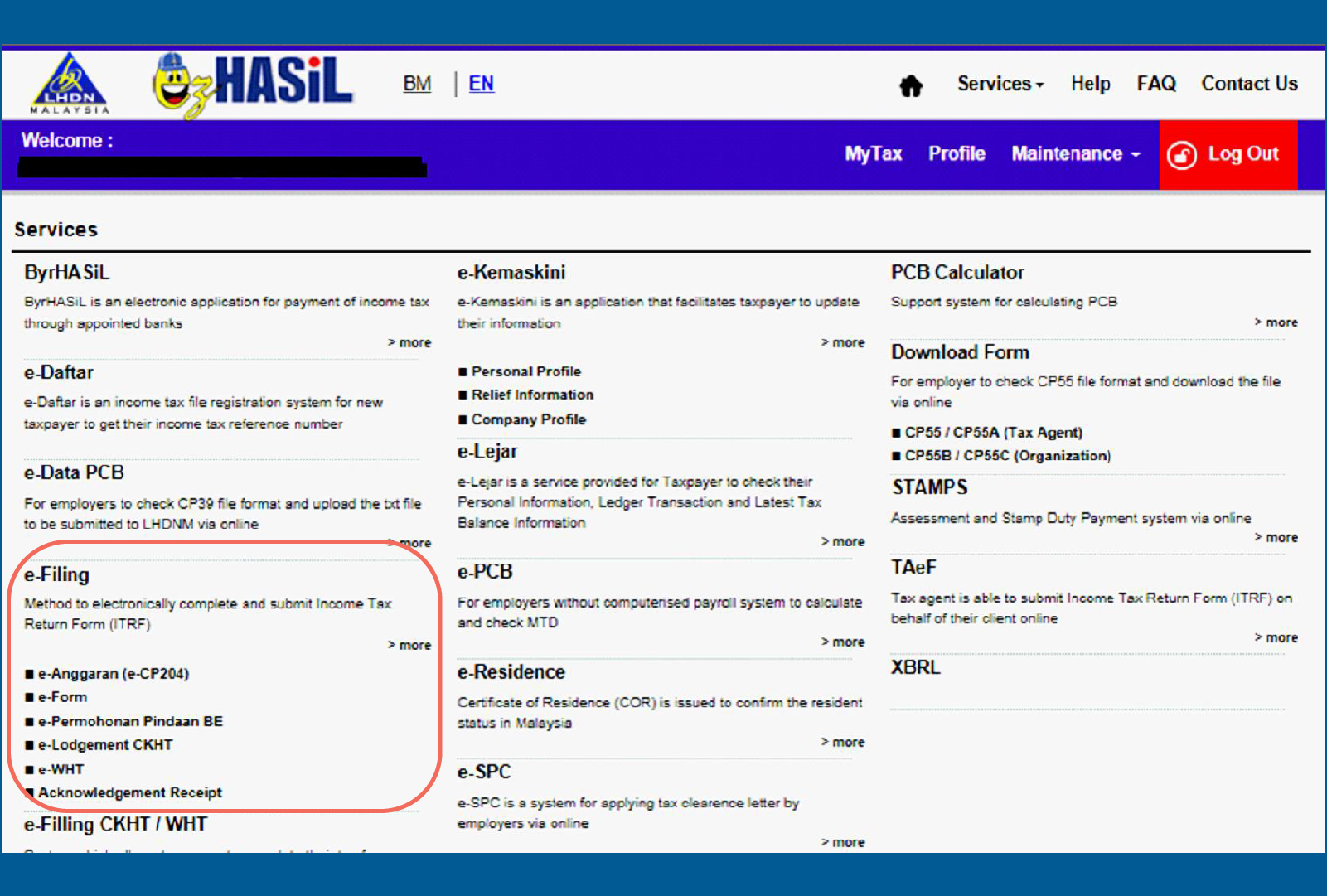

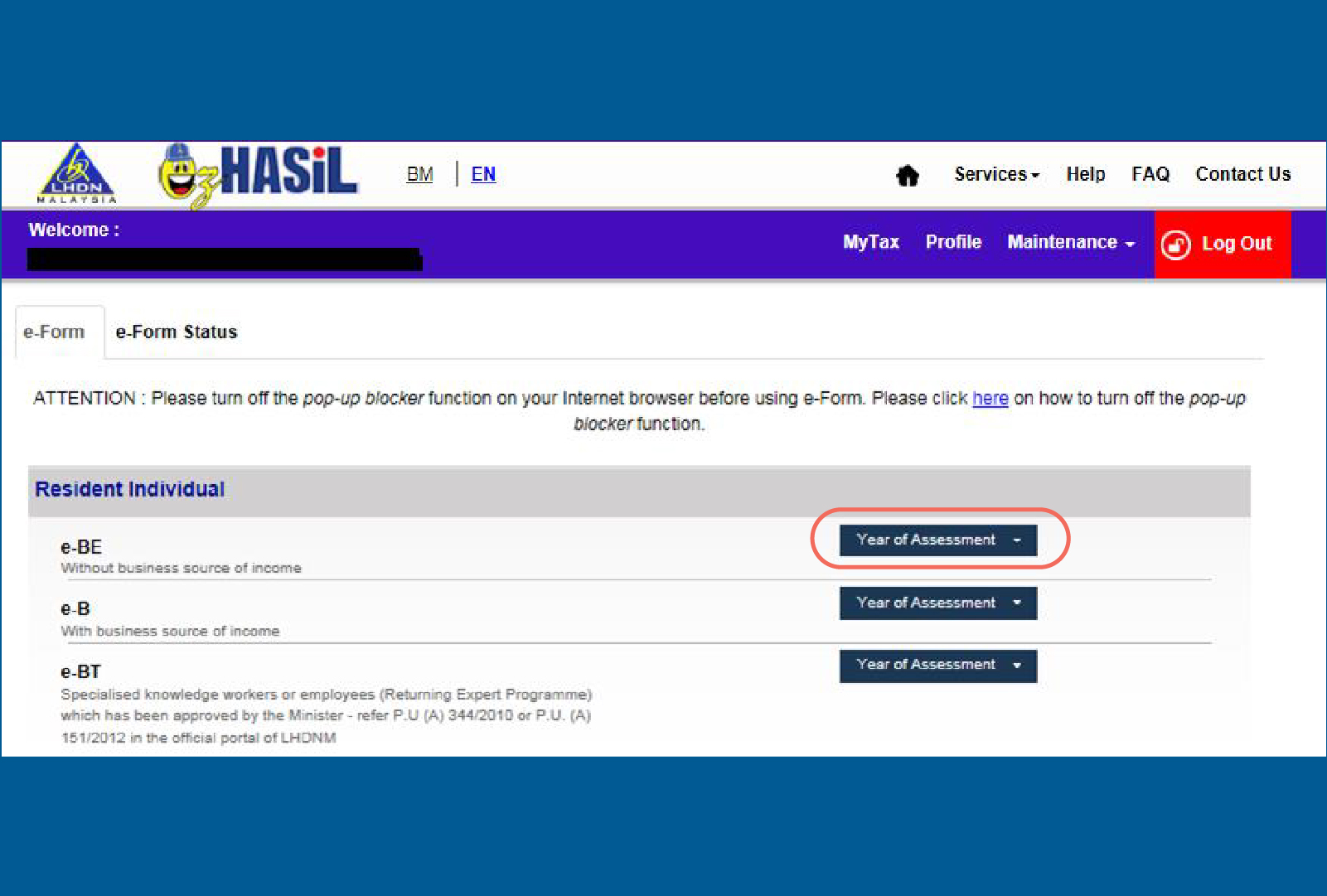

3. Once you’re done logging into the website, the page will straight away bring you to a variety of options (as per shown in picture below).

In it, look for [e-Filing] and click on [e-form].

The next page will bring you to choosing your applicable form types. Choose [e-BE] and then click [Year of Assessment]

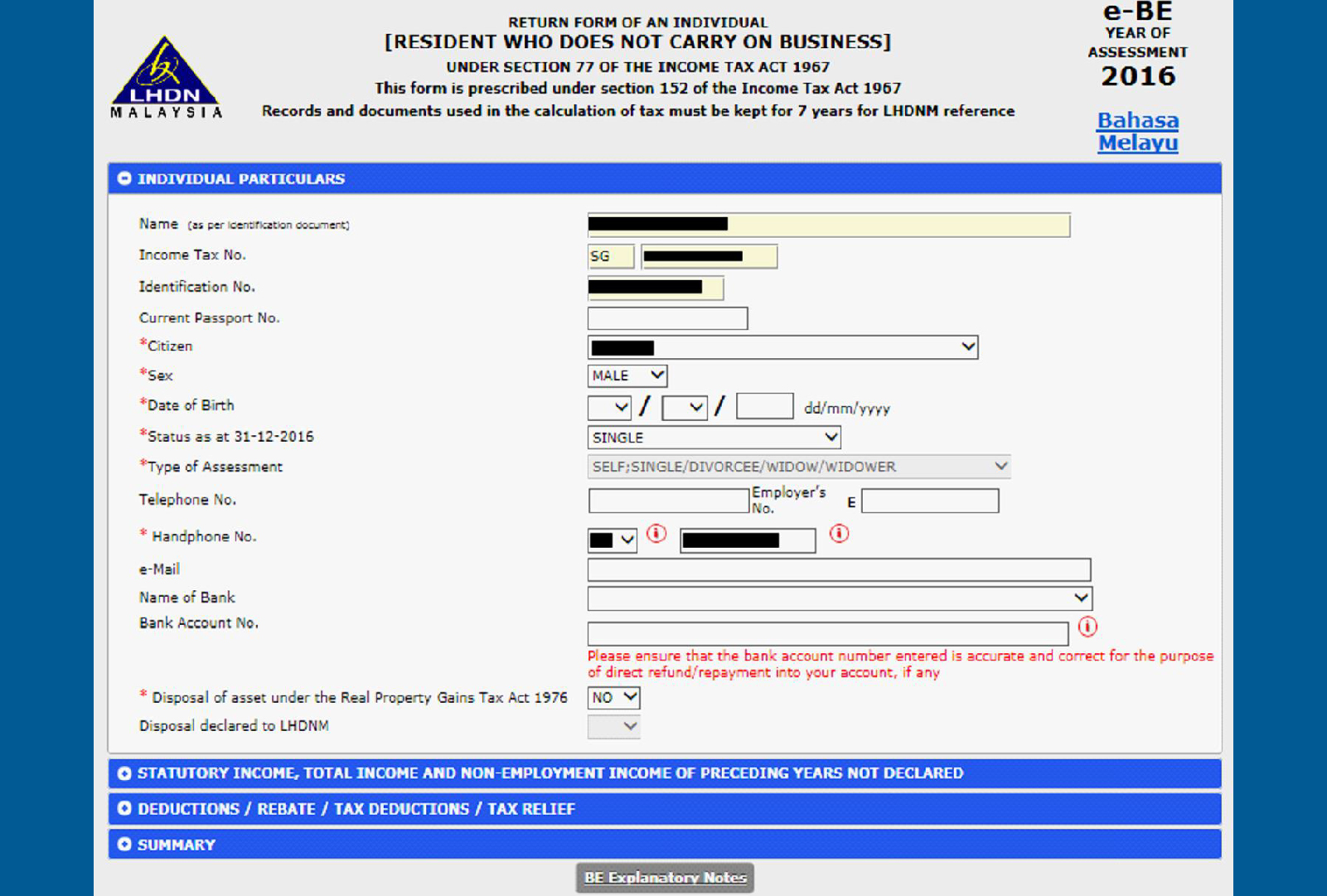

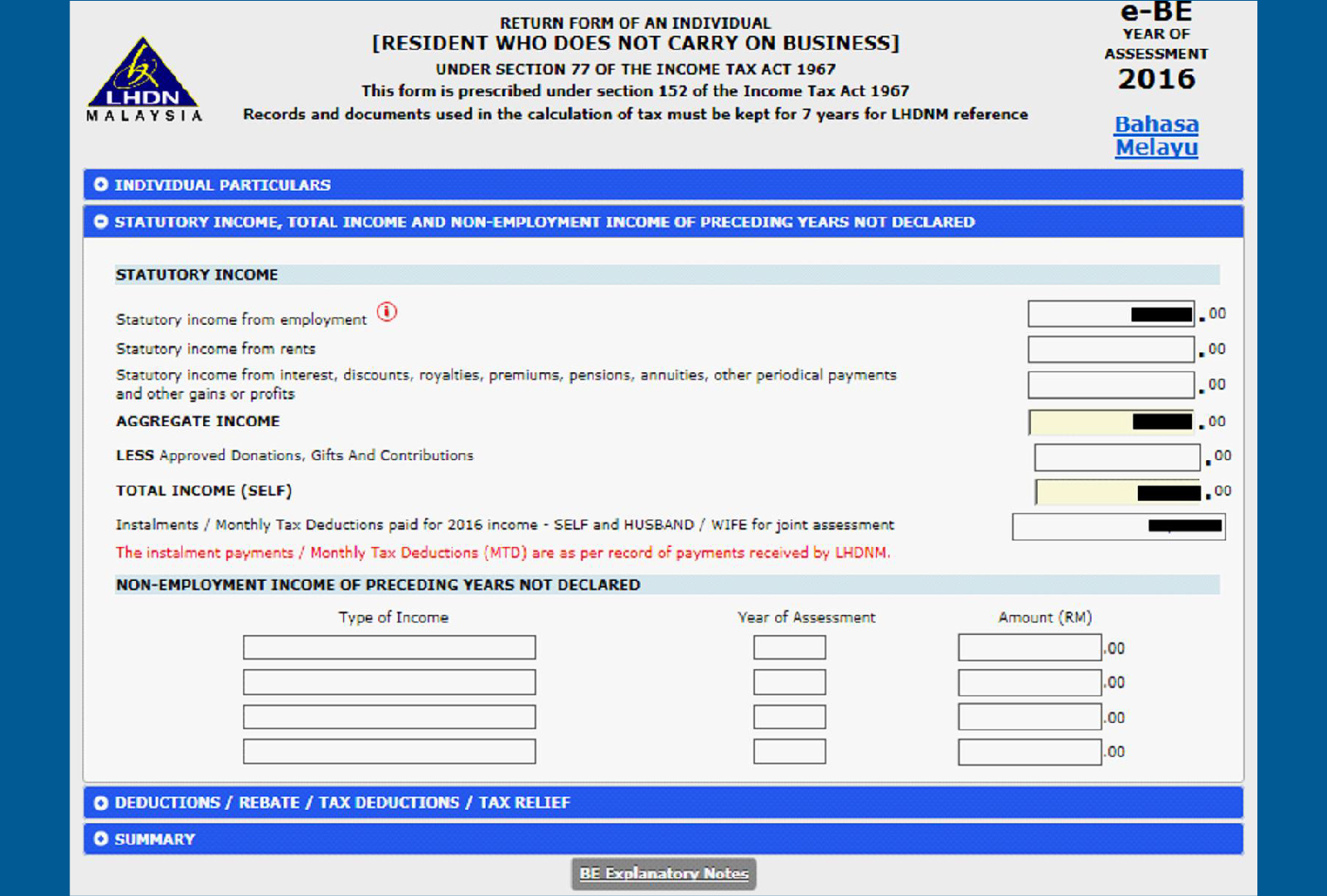

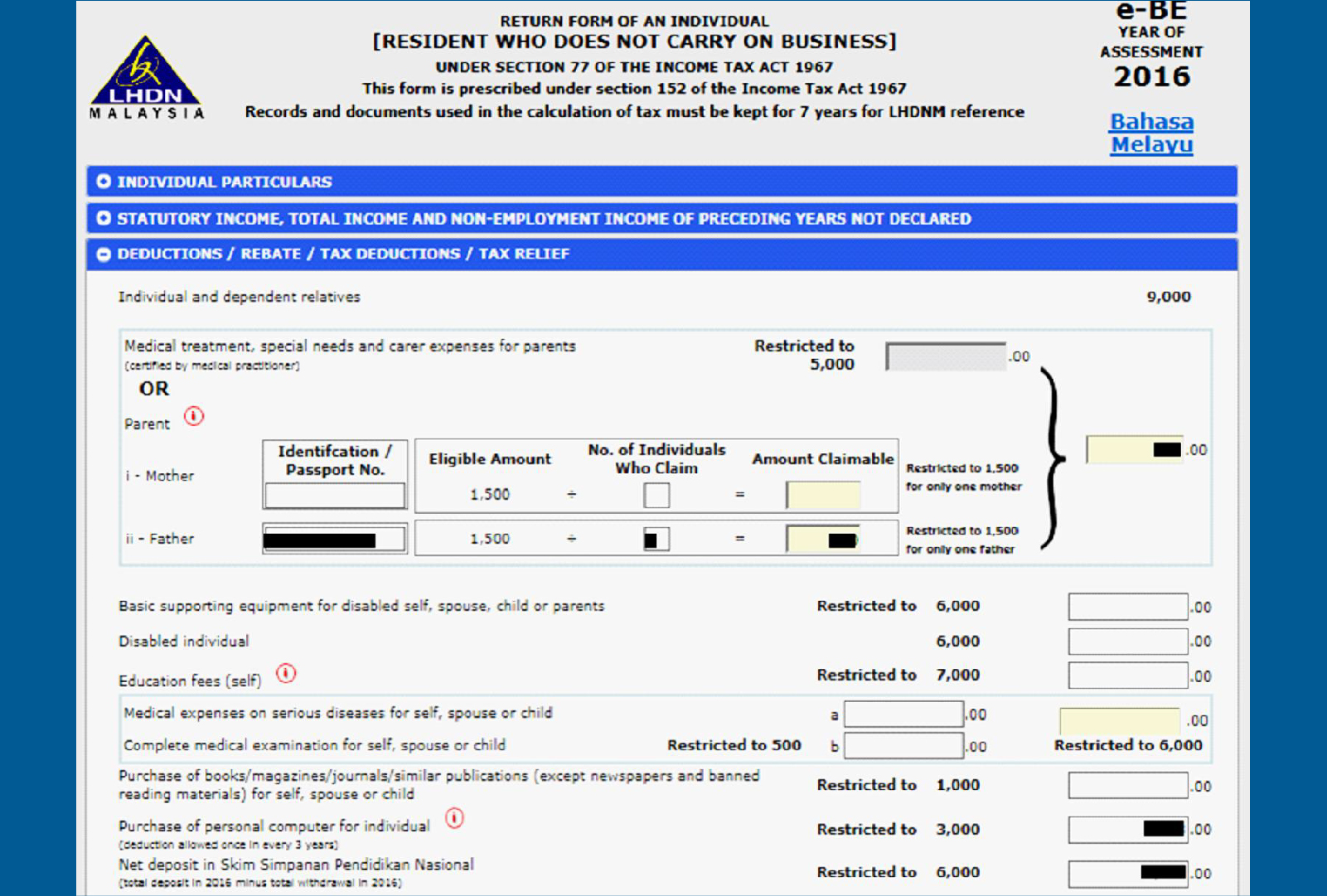

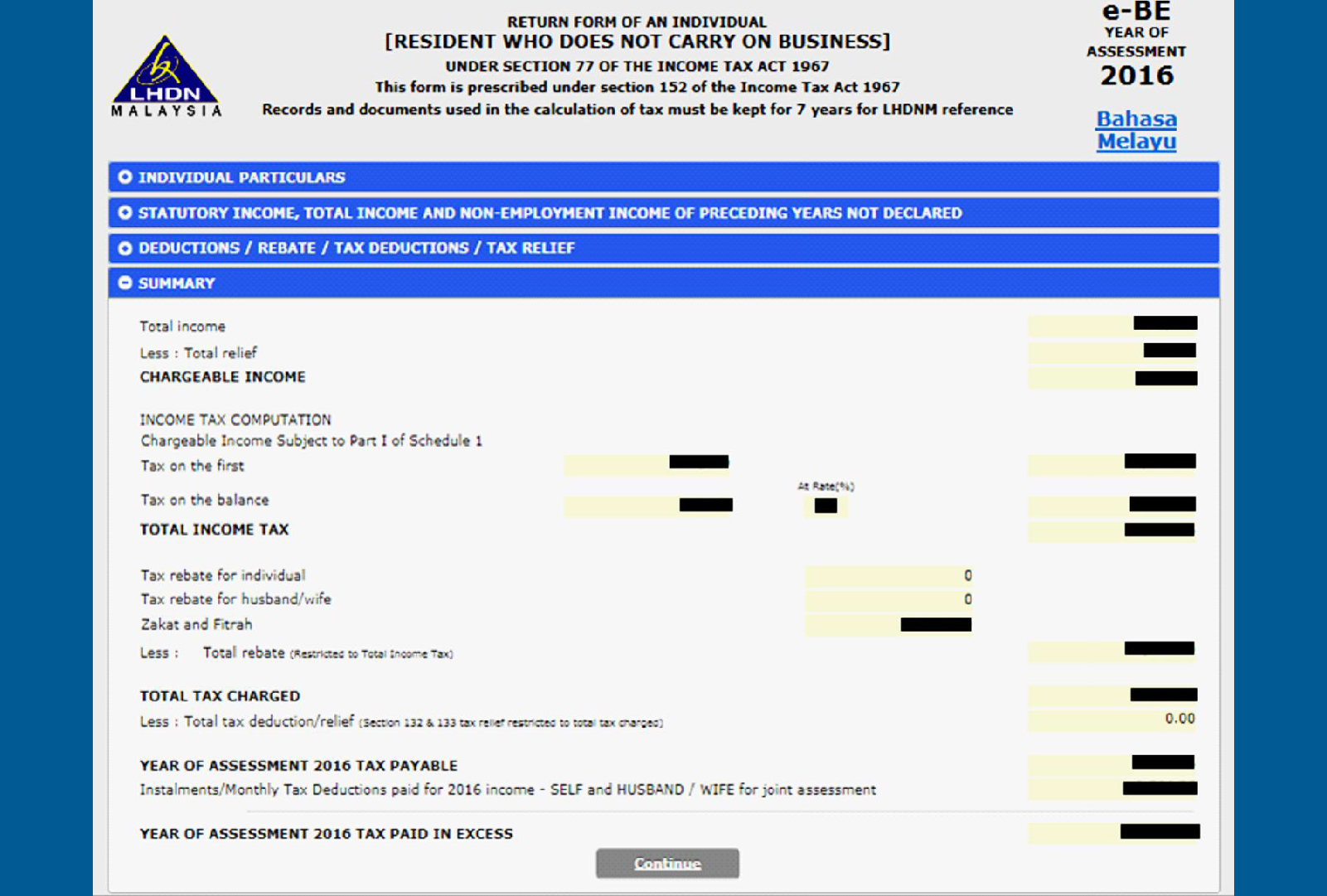

4. E-form and E-BE will appear with information divided into 4 sections:

- Individual Particulars

- Statutory Income, Total Income and Income of Preceding Years Not Declared

- Deduction / Rebate / Tax Deduction / Tax Relief

- Summary

From there, fill in your personal details for those sections. Make sure you don’t miss out on what's important. After filing it in, you can proceed to click [Sign and Submit].

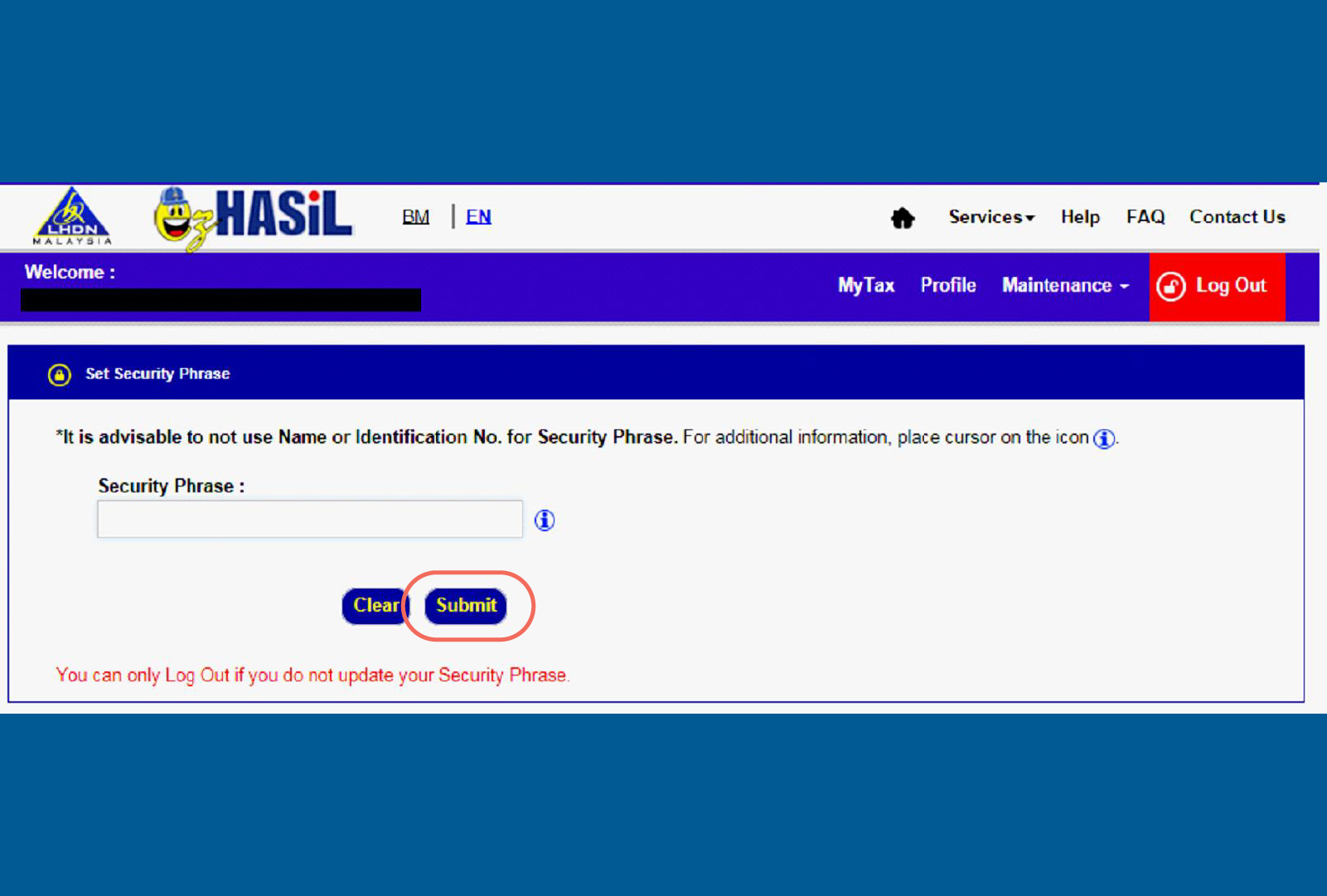

Re-entering your security phrase

In cases that you have already log-in to the LHDN website before but you forgot your security phrase, don’t worry as you can re-type a new security phrase. By doing so:

- From the log-in page, fill in your IC number and then click [Submit]

- Enter your password click [Proceed]

- After that, a message regarding “Security Phrase” will be displayed.

- From there, you can enter the letters/symbols/numbers of your choice for your Security Phrase. Make sure it’s something only you know and understand in order to protect your account. After that, click [Submit]

Remember to always do your yearly taxes! If you aren’t still sure on how to fill up the E Form online, you may contact myconsult for enquiries.