PERMAI Assistance Package: Additional Benefits

Additional benefits have been added in the Permai Assistance Package as it was announced by the government on January 18th. The Perlindungan Ekonomi & Rakyat Malaysia (PERMAI) Assistance Package that is valued at RM15 billion was announced to focus on the improvement and the acceleration of the existing initiative. This is to help fight the COVID-19 outbreak, keep the welfare of the people safe and to help bring support and continuity of businesses.

Extension of the moratorium

Moratorium facilities, including extension of the moratorium and restructuring of loan repayment, will continue to be offered by banks. A moratorium will be given to businesses who are taking out loans from TEKUN Nasional, Majlis Amanah Rakyat (MARA) until March 31, 2020. To add on, a 30% discount has been provided by MARA for 6 months, starting November 2020 until April 2021. This is for those who are renting for business premises.

Healthcare workers and frontliners

As the frontliners and healthcare workers do their very best to help the sick citizens. PERMAI will be offering a one-off payment of RM500 for all medical frontliners. They are given RM300 in the first quarter of 2021. With a total of 3,500 healthcare workers, they are being recruited with the allocation of RM150 million.

Expansion of the “Prihatin Special Grant Plus”

Government to expand the Prihatin Special Grant Plus assistance to cover more than 500,000 SMEs that are currently under MCO. The states that are under MCO will be given RM1,000 to each SME whereas RM500 will be given to each SME in states that are not under MCO.

Tax exemptions with PERMAI

Local passenger vehicles were eligible for 100% sales tax exemption and imported passenger vehicles for 50% sales tax exemption under the PENJANA package. That was effective on 15th June 2020 until 31st December 2020. This also applies to those who purchase computers, handphones and tablets. PENJANA provided income tax relief to individuals of up to RM2,500 from the month of JUne until the end of December 2020.

With PERMAI, tax exemptions for the passenger vehicles have been extended until 30th June 2021. The purchase of the electronic devices has also been extended until the end of December 2021.

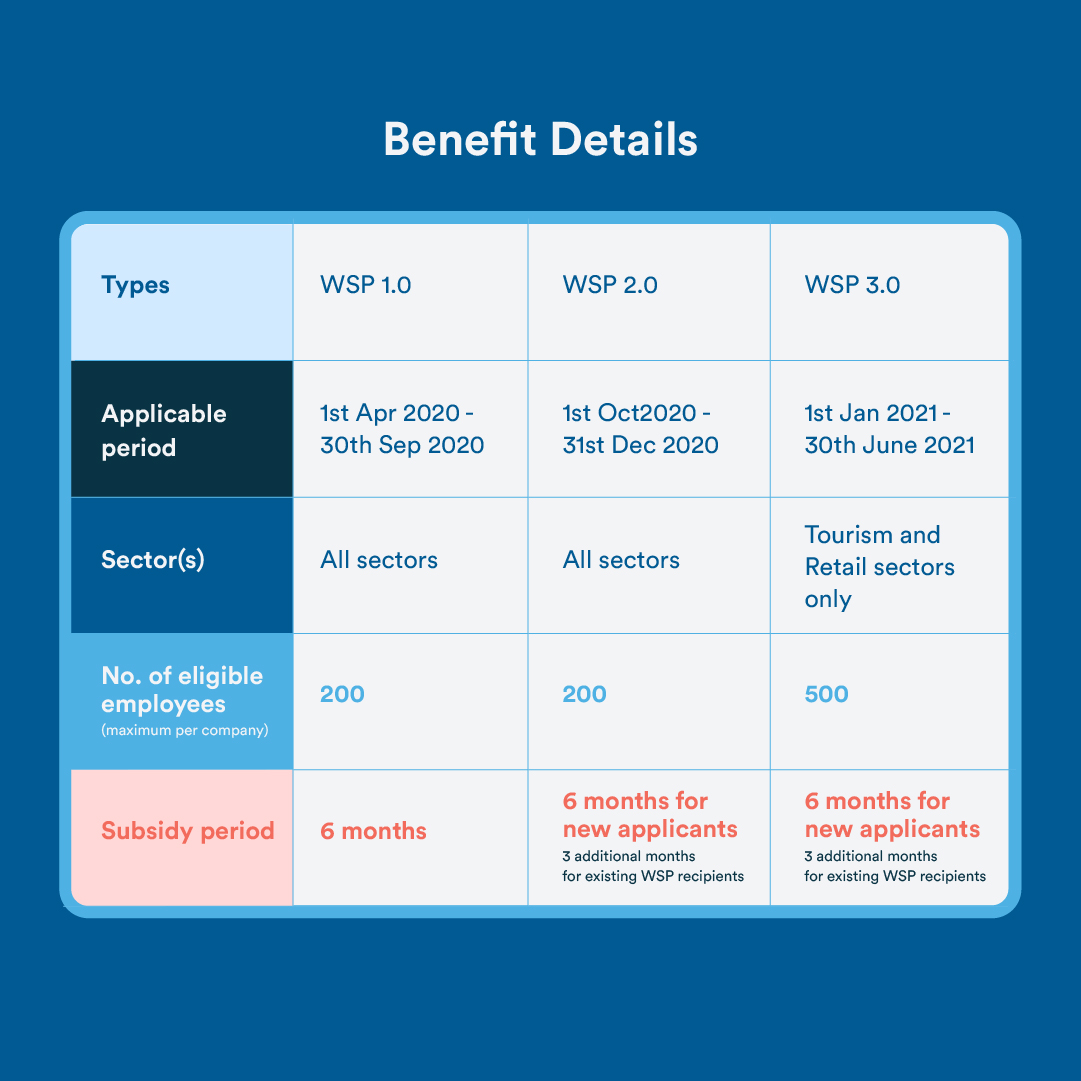

Wage Subsidy Programme 3.0 under Socso will be enhanced

The WSP was introduced to lessen the burden of the employers who are suffering financially as well as employers that did not reduce the salary income of their employees that are earning less than RM4,000. All employers operating in the MCO states will be eligible to apply, irrespective of sector.

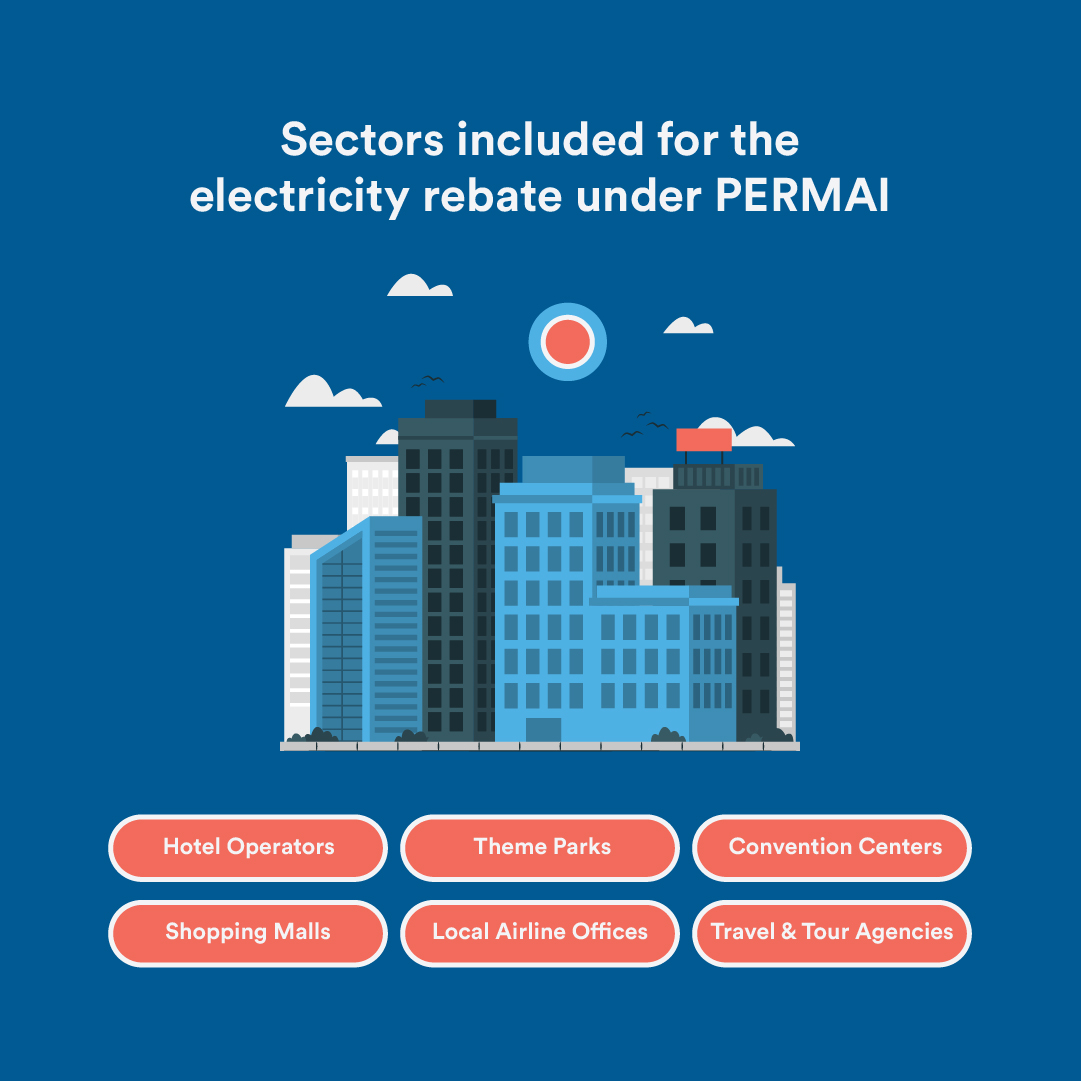

Electricity rebates to all TNB users

Including both domestic and non-domestic, at a rate of two cent per kilowatt-hour equivalent to a reduction in electricity bills of up to 9% for a period of six months from 1st January to 30th June 2021.

With that being said, here are the key takeaways from the additional benefits of the PERMAI Assistance package. We hope that your business will continue to thrive high. If you have any problems with your financial side of the business, contact myconsult as we can help you find a better solution to your problems.