Preparing The EA Form in SQL Payroll

As we begin a new year, it’s important to prepare a few statutory forms for submission to close your yearly payrolls. This process comes in preparing the EA and E forms. If you are using a payroll software like SQL Payroll, you can generate the necessary reports required in only a few minutes.

Preparing the EA form in SQL Payroll

EA form is a Yearly Remuneration Statement that includes your salary for the past year. Employers must prepare the form for their workers to file personal taxes during tax season. It is important to do so before the last day of February in the following year.

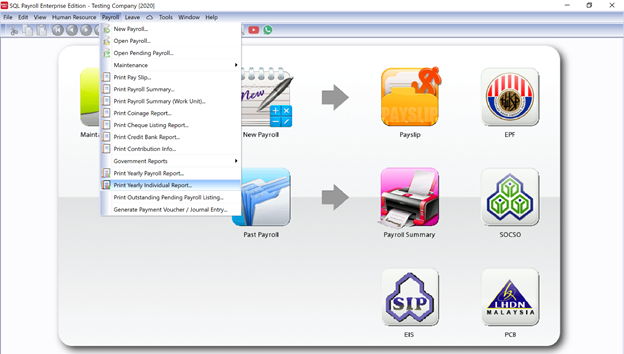

Here are steps on how to use SQL Payroll to prepare the EA form.

- To prepare an EA form, you must first ensure that every employees’ payroll of the current year is correct. Go to [Payroll] ➡️ [Print Yearly Individual Report]. This is to check your worker’s yearly contribution.

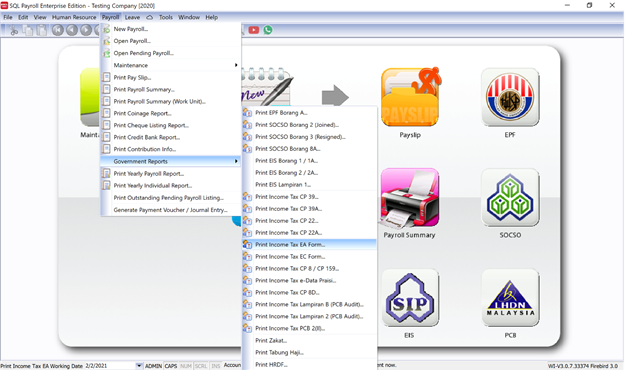

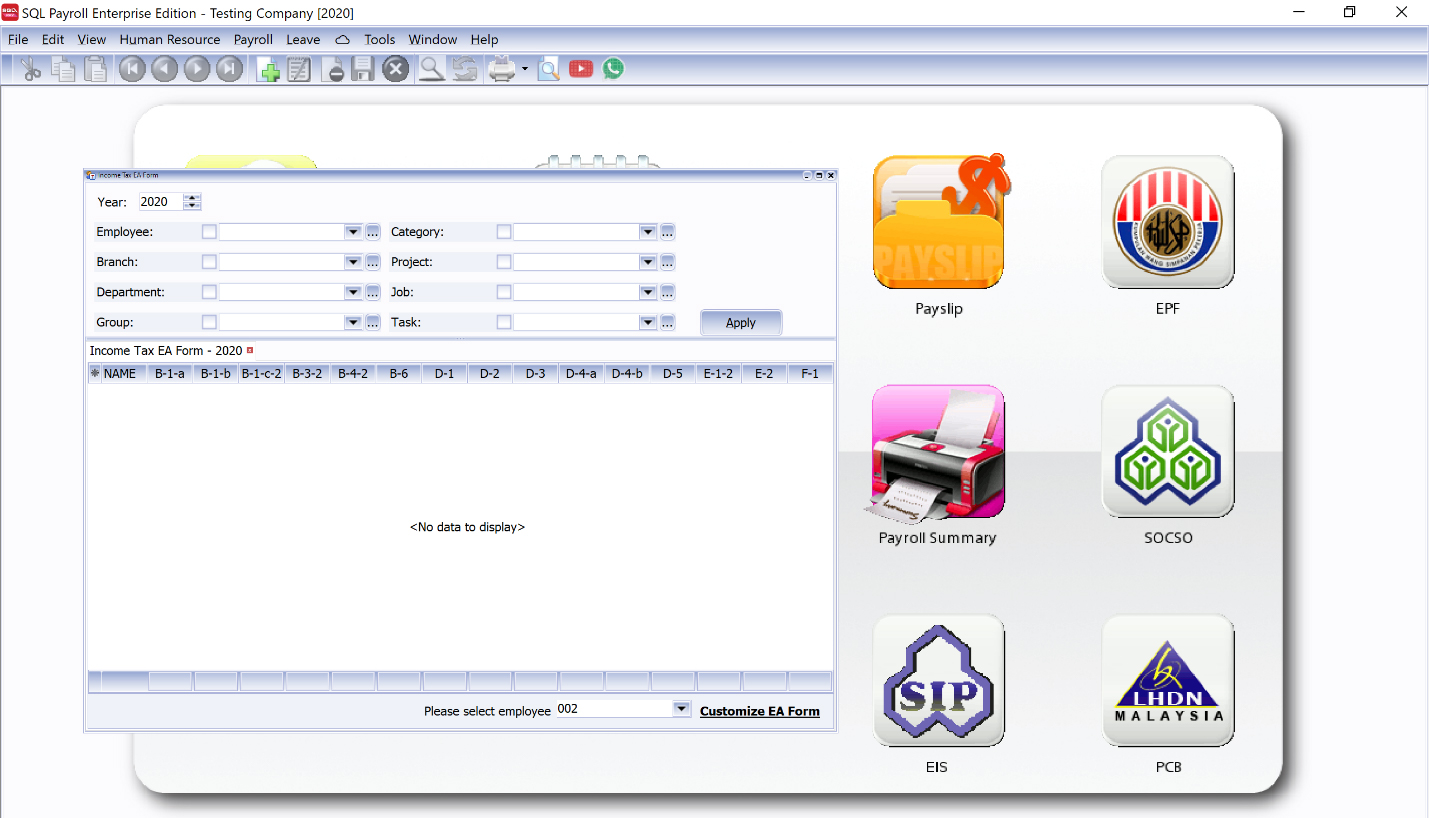

- Once checked, you can then generate the EA form by clicking [Payroll] ➡️ [Government Reports] ➡️ [Print income Tax EA Form].

- If some of the employees received some form of benefits in kind, It's important to input the value in their EA form. To do that, you need to click and select the number of the employee at the bottom and click [Customize EA Form]. Once done, you can generate the EA form and send it to your employees

Preparing the E form in SQL Payroll

E forms are for declaration reports to inform the IRB on the number of employees and the list of employee's income details. The dateline to submit your E Form for 202o would be on the 25th February 2021. Here are steps to preparing the E form.

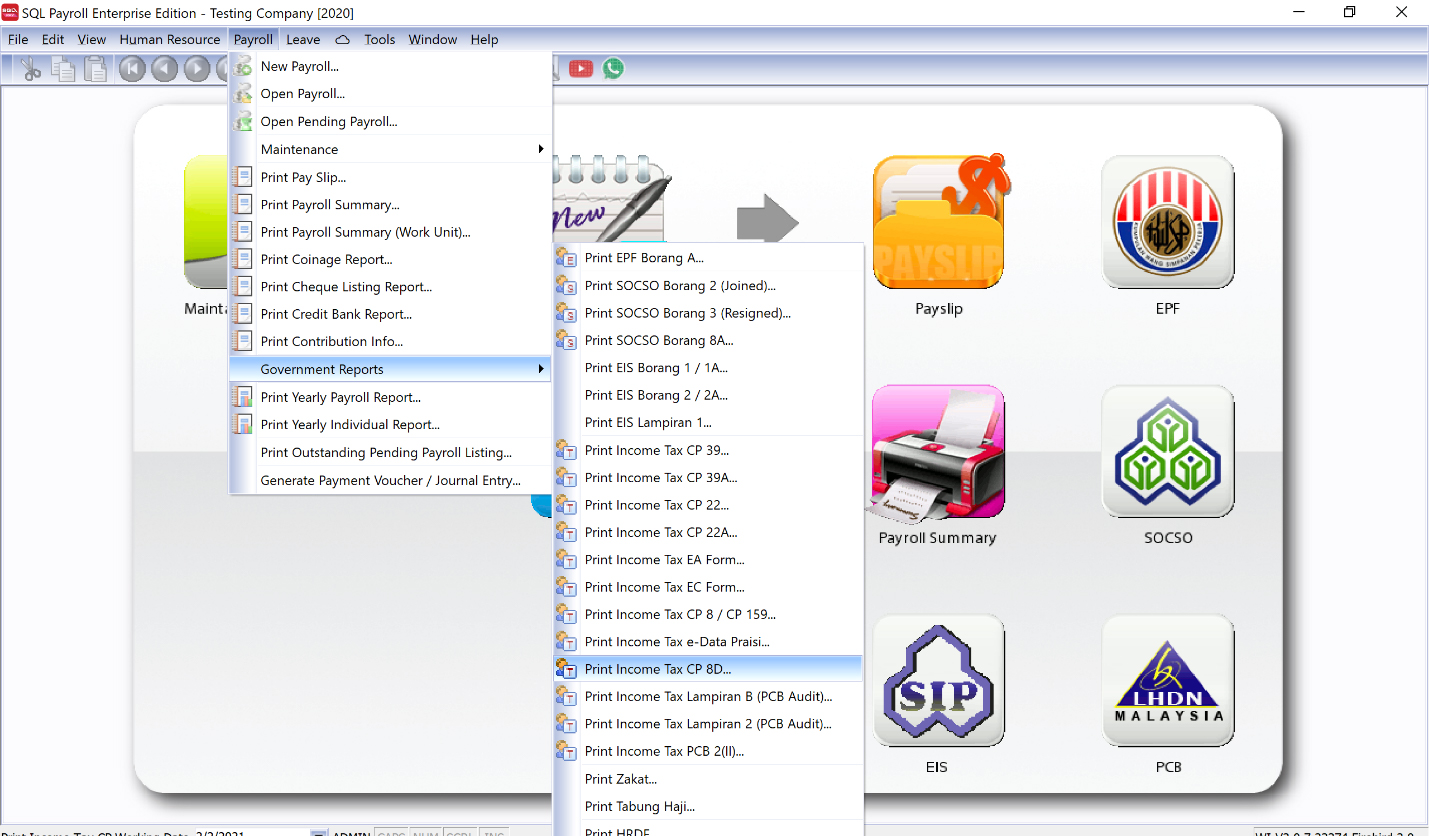

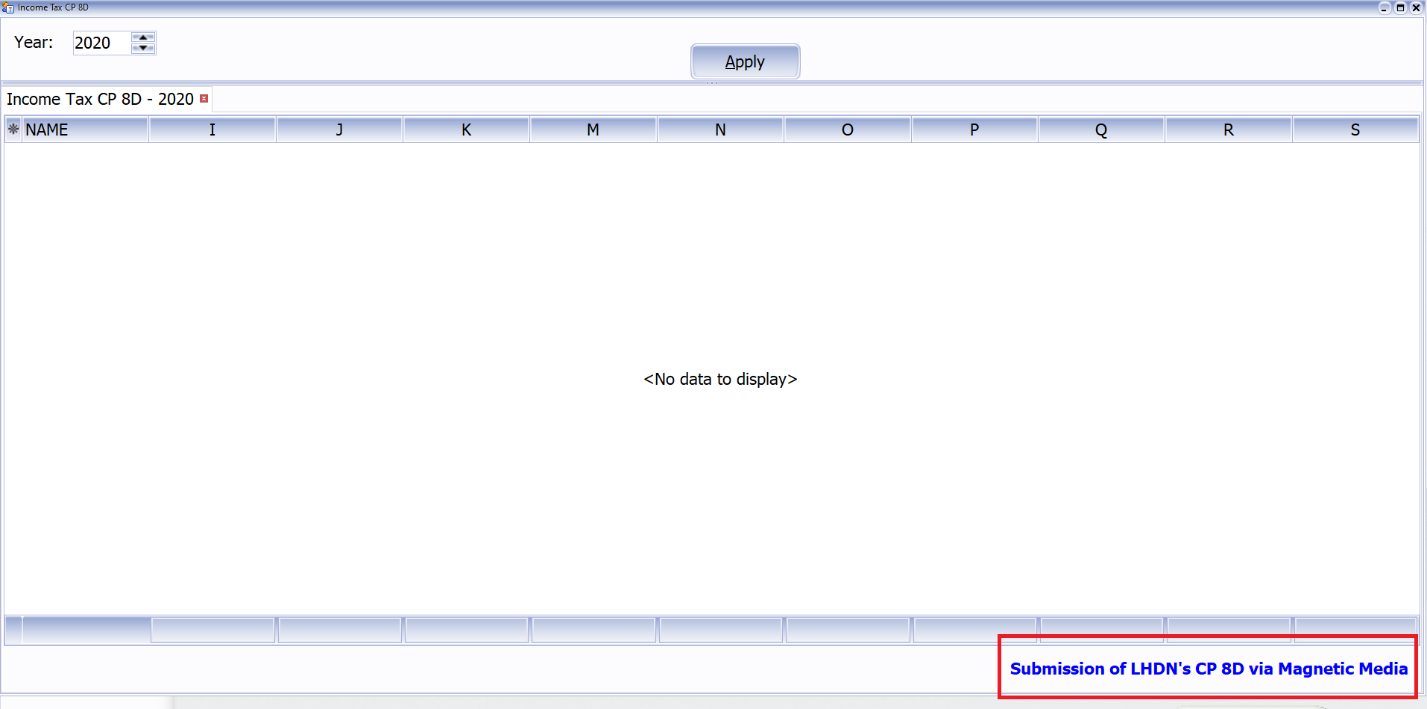

- Go to [Payroll] ➡️ [Government Reports] ➡️ [Print Income Tax CP8D].

- Once done, click on [Submission of LHDN CP8D via Magnetic Media] on the bottom right. This is to generate a file to be uploaded onto the LHDN website.

It is essential that employees to file their tax returns before 30 April of the following year. If this form is not completed by the employer or employees, a fine will be issued by the Malaysian Government.

What if I don’t have SQL Payroll Software to settle my taxes?

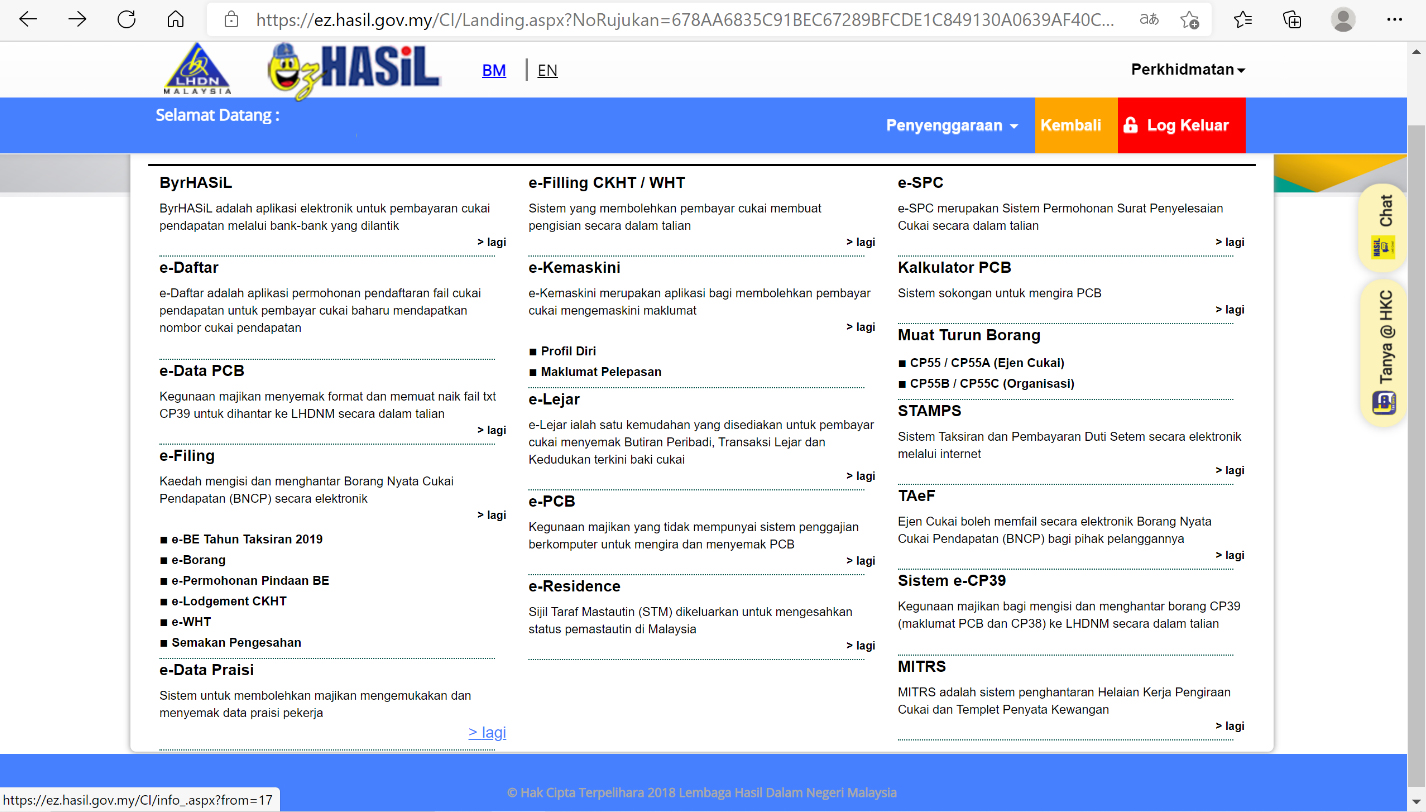

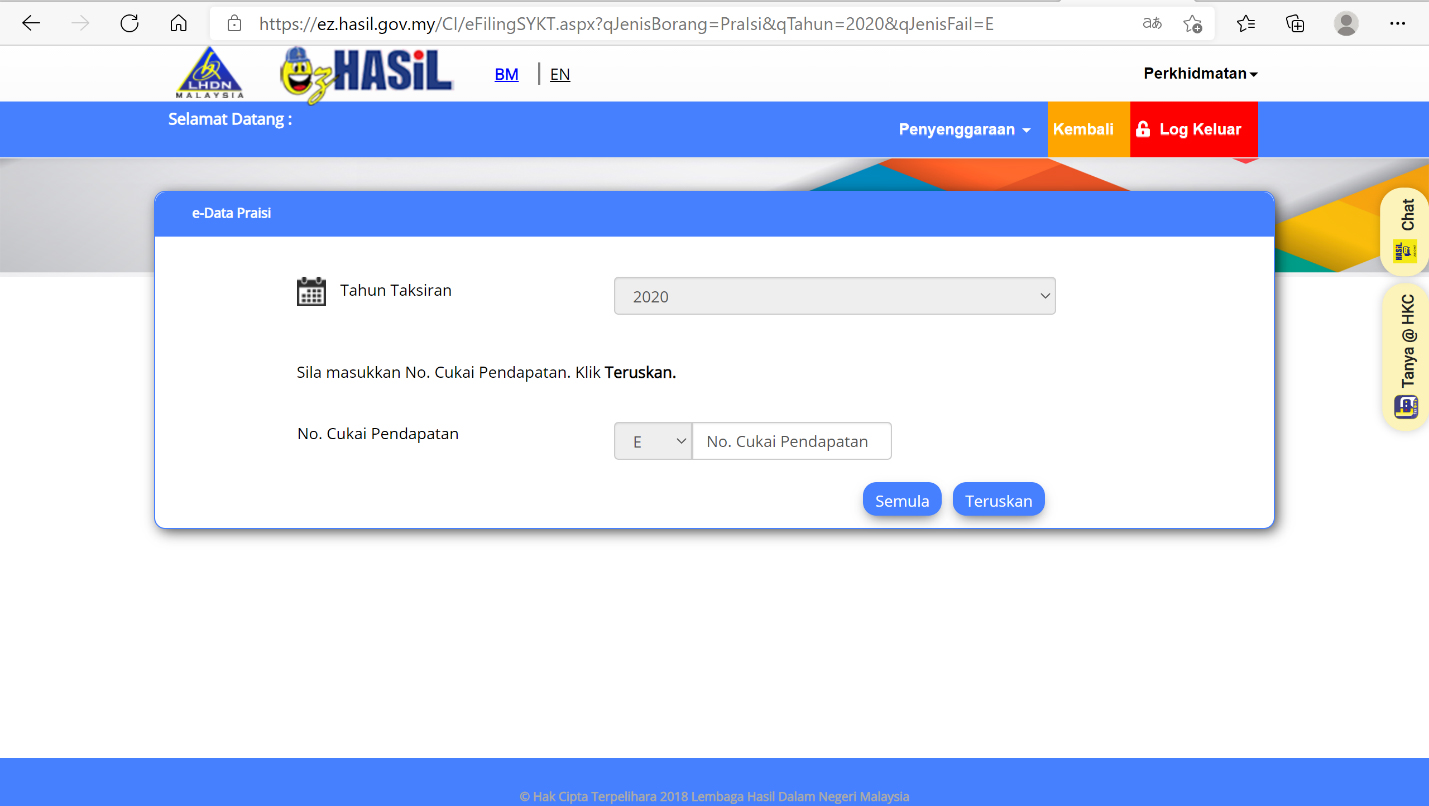

DON’T WORRY! If you do not have a payroll software, you can go to the LHDN website to download an excel template to manually key in your payroll details. This requires employers to manually update the details by logging into their account on the LHDN website. Once you logged in, you would need to click [e-Data Praisi].

After that, fill in your E number and proceed by clicking [Teruskan].

What must you know when you’re earning an income in Malaysia?

All employees with an income in Malaysia are required to file an income tax return once a year. Filing requires reporting the income that they earned. Tax returns are to be filed before 30th April of the following year. This tax return form can be completed online. If you wish to appoint a payroll partner to complete it on your worker’s behalf, the following information is needed.

- The worker’s income tax number

- A copy of the worker’s latest salary statement (EA/EC Form)

- Personal identification number (PIN) for online system (if this is your first time paying taxes in Malaysia, you will need to register with the IRB and obtain your PIN)

A fine will be issued by the Malaysian government if employers or workers did not complete and submit the form.

These are important information that you must know when filing your tax return. Don’t forget to keep your receipts for filing purposes. It’ll help you in the next following year when tax season comes again!