Malaysia Budget 2021:

What You Need To Know

After several discussions, the government has decided to bring in “Malaysia’s Budget 2021” where the funds will be given away to various segments and industries nationwide. This would mainly improve the welfare of the people and boost the country’s economy that has been affected by the Covid-19 pandemic.

A value of RM322.5 billion made for Malaysia's Budget 2021 is the largest expenditure in history which includes higher spendings from the Government, selective tax reliefs and targeted incentives in support for private domestic demand. RM236.5 billion has been allocated for operating expenditure, RM69 billion for national developments, and RM17 billion for the Covid-19 fund. Here are the few pointers you should take note about Malaysia Budget 2021:

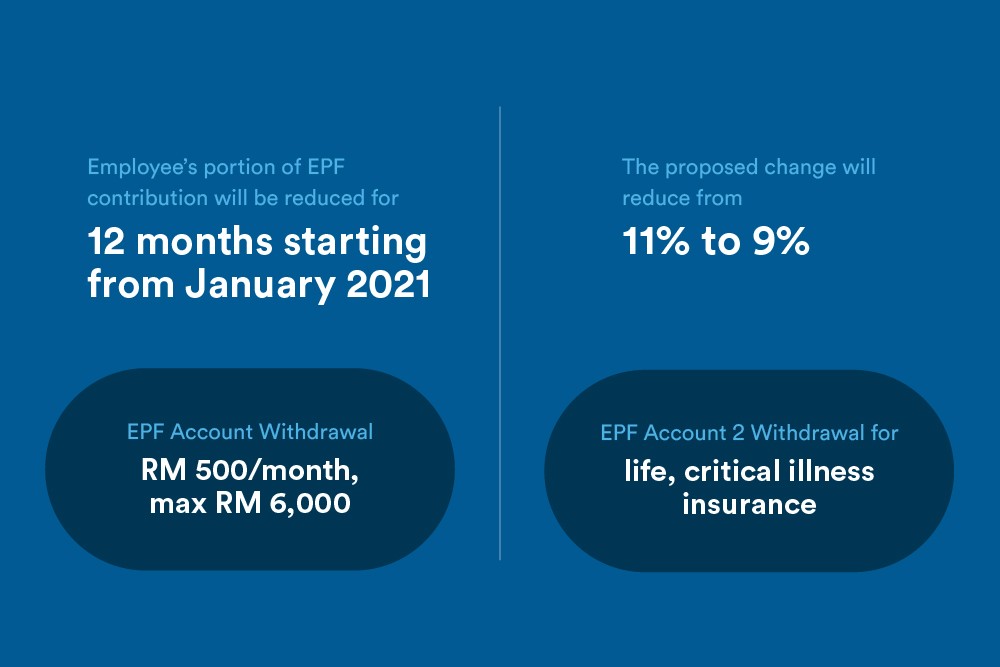

1. EPF contributions

Employee’s portion of EPF contribution will be reduced for 12 months starting from January 2021. The proposed change will be reduced from 11% to 9%.

Government allows:

- EPF Account 1 withdrawal: RM500/ month (max RM6,000)

- EPF Account 2 withdrawal for life, critical illnesses insurance

Moreover, the government has also planned a budget for employment injury schemes. RM24 billion will be allocated for SOCSO’s employment injury scheme including delivery riders and contributors to private retirement schemes are allocated to tax exemptions of RM3,000. RM150 million is also allocated to extend SOCSO’s job search allowance for 3 months.

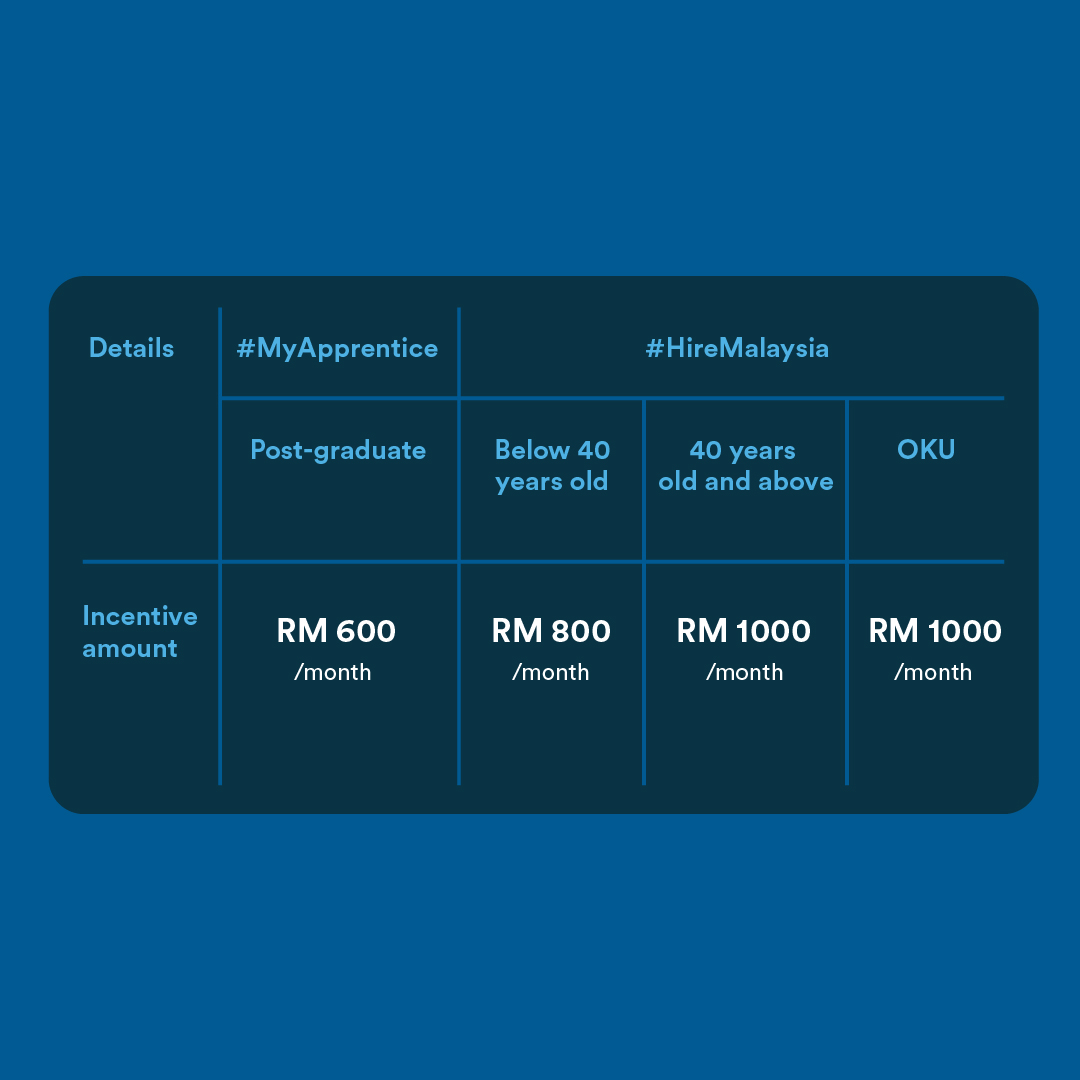

2. PenjanaKerjaya - Hiring Incentive

PenjanaKerjaya is a Hiring Initiative Programme where eligible applicants can apply to increase job opportunities and employability among local job seekers. Only certain sectors are eligible for certain applicants as followed:

- Employers who have registered the followings before 1 June 2020:

- Companies Commission of Malaysia (SSM)

- Department of Registrar of Societies (ROS)

- Registration of BUsiness (ROB) Local Authority (PBT)

- Employers who have registered with SOCSO before 1 June 2020

- #MyApprentice is to encourage employers to employ post-graduate and post-school as apprentices.

- Post-graduate - RM600/ month

- #HireMalaysia - 3 categories:

- Employee below 40 years old

- Employee that is 40 years old and above

- Employee that is under OKU or participants under Program Return to Work (PERKESO)

How to apply for PenjanaKerjaya Programme:

1. Register from 15 June 2020 onwards through: penjanakerjaya.perkeso.gov.my

2. Enter the employers profile in the website link. Through that, the employer of your choice can submit an application for Program Insentif Pengambilan Pekerja for new employees under this incentive from 1 July 2020.

3. Tax exemptions

Income tax for those earning between RM50,000 - RM70,000 per year has a decrease of 1% tax exemption. Additional RM500 has been added for lifestyle relief schemes specifically for sports related expenses. Lastly, expenses on medical treatment and special needs has an additional of RM3,000 tax relief.

As tough times continue to rise, we must be able to come together and do our part in the business and to help those who are financially unstable or having a tough time in finding a job during the pandemic.

With myconsult, give a call and let us help you find solutions to your business problems. We are specialized in advising you the best of the best in order to have your business grow.

Let myconsult help you in #connectingthedots